Good primer on open banking by Blanca labs – PDF

Open Banking is transforming financial services by enabling secure data sharing between banks and authorized third-party providers (TPPs) through APIs.

Key Themes:

• From Screen Scraping to Open Banking: Screen scraping is insecure. Open Banking addresses this with standardized APIs and enhanced security, ensuring transparent and secure data sharing.

• Consumer Benefits: It gives customers control over their data, leading to innovative services like personalized financial management, account aggregation, and faster credit assessments.

• Opportunities for Banks and FinTechs: It drives innovation and collaboration, allowing banks and FinTechs to create new revenue streams, improve customer experiences, and gain deeper insights into financial behavior.

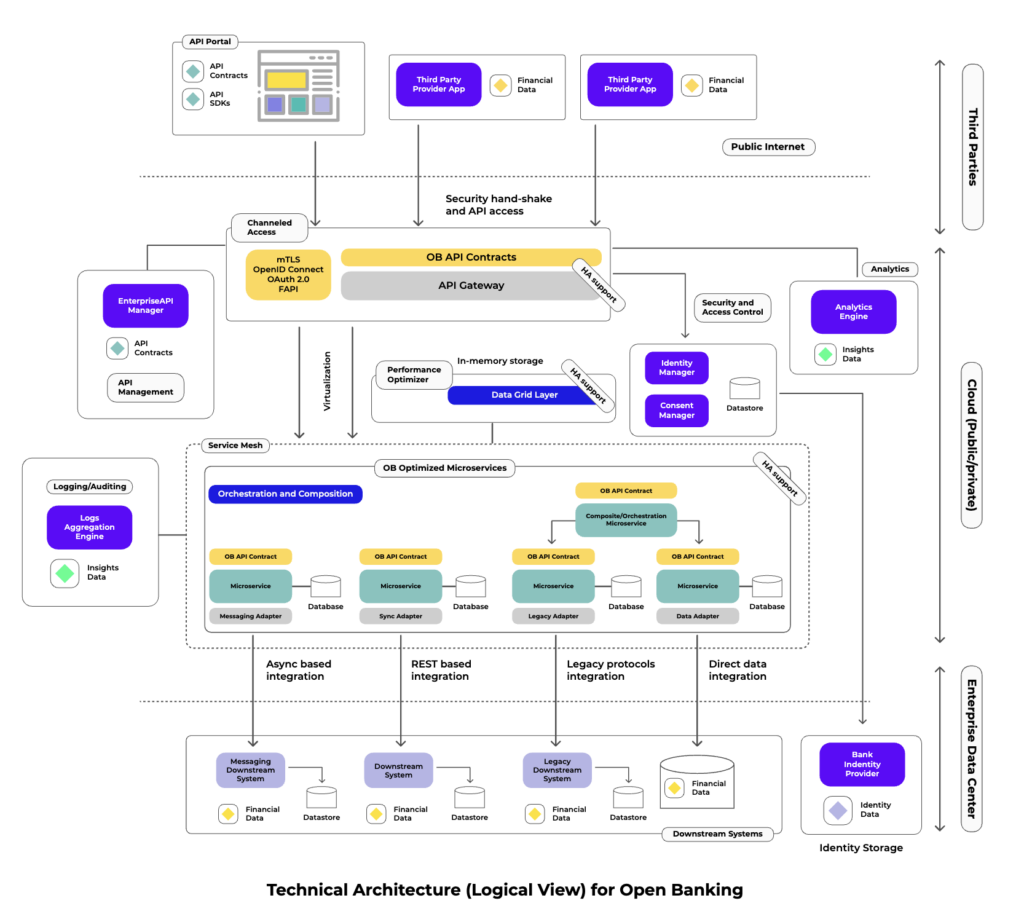

• Technical Architecture: A microservices-based Open Banking platform includes API gateways, consent managers, analytics engines, and secure microservices for data exchange.

• Best Practices: Leveraging existing platforms, robust security, flexible architecture, CI/CD pipelines, cloud infrastructure, and API standardization (OAS) are key to successful implementation.

Important Facts:

• FDX Standard: In North America, the FDX standard unifies Open Banking’s technical requirements.

• Cloud Infrastructure: Critical for scalability and flexibility in Open Banking solutions.

Conclusion:

Open Banking is revolutionizing the industry. Financial institutions that embrace its principles and best practices can drive innovation and deliver enhanced customer value.